There is no support from accumulated volume below today's level and given the right condition the stock may perform very badly in the next couple of days. Volume fell together with the price during the last trading day and this reduces the overall risk as volume should follow the price movements. Further fall is indicated until a new bottom pivot has been found.

A sell signal was issued from a pivot top point on Tuesday, October 04, 2022, and so far it has fallen -7.43%.

A break-up above any of these levels will issue buy signals. On corrections up, there will be some resistance from the lines at $66.09 and $72.01. Also, there is a general sell signal from the relation between the two signals where the long-term average is above the short-term average.

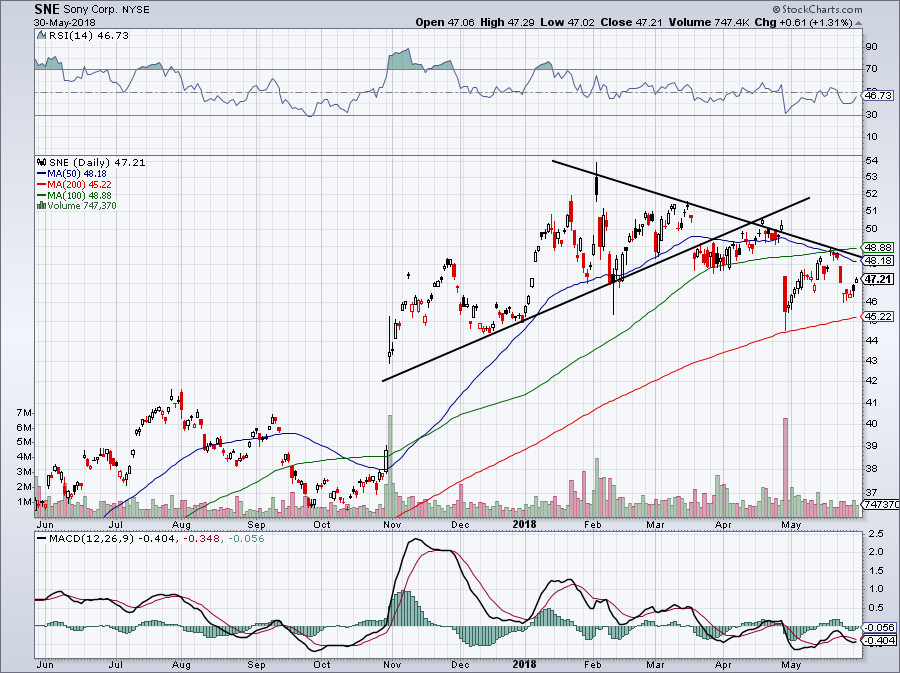

The Sony Corp Ord stock holds sell signals from both short and long-term moving averages giving a more negative forecast for the stock. Some negative signals were issued as well, and these may have some influence on the near short-term development. Furthermore, there is a buy signal from the 3 month Moving Average Convergence Divergence (MACD).

0 kommentar(er)

0 kommentar(er)